Categories

Hyper-depreciation 2020 of suction systems 4.0: what changes in 2020 Budget Law?

For companies that have decided to invest in air quality by installing suction and filtration systems, new and important innovations have been planned: a new tax credit 2020 instead of Hyper depreciation and super depreciation has come.

Since 1 January 2020, in fact, Hyperamortization and Superammortation have been replaced by a new tax credit for investments in capital goods, as foreseen by an amendment to the 2020 Budget Law approved by the Senate Budget Commission at the request of the Mise.

The new 2020 tax credit involves, as in previous years, also the suction and filtration systems compliant with 4.0 and provides percentages divided as follows

– 40% of the purchase cost for the investment share of up to EUR 2.5 million;

– 20% for the share of investments in excess of EUR 2.5 million and up to the maximum limit of eligible costs of EUR 10 million.

This new tax relief measure helps small and medium-sized enterprises who want to improve air quality or processes by installing suction systems, providing them with the opportunity to recover 40% of the amount spent as tax credit to use, for example, compensation in F24 payments.

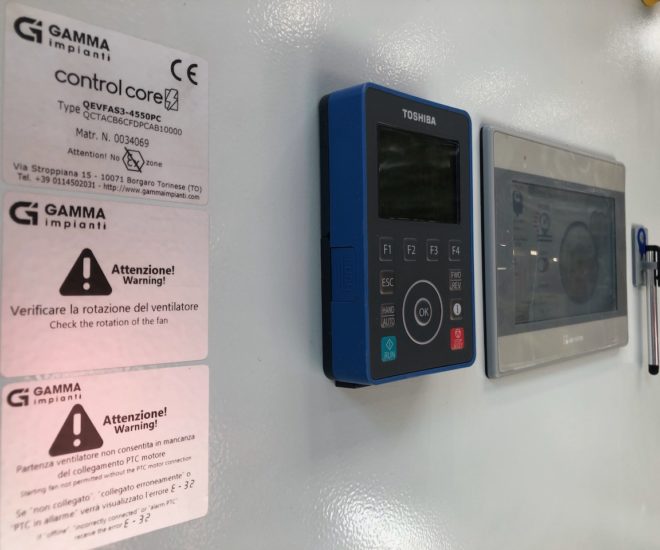

Despite the new formula with the tax credit, for the suction systems there is no change to the current regulations on Industry 4.0 for which the technical equipment, engineering, and sworn expertise provided by us together with the electrical panels, are, as has already happened in recent years, valid safety guarantees for those who invest in suction systems.

But let’s remember what are the basic requirements of suction systems to be compliant with industry 4.0

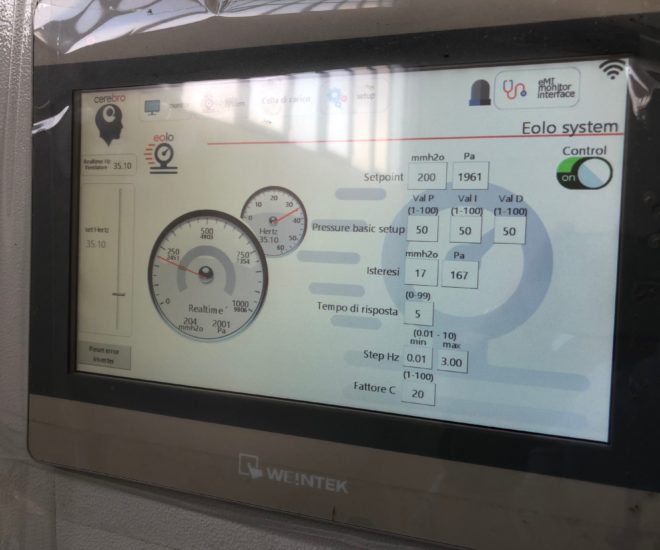

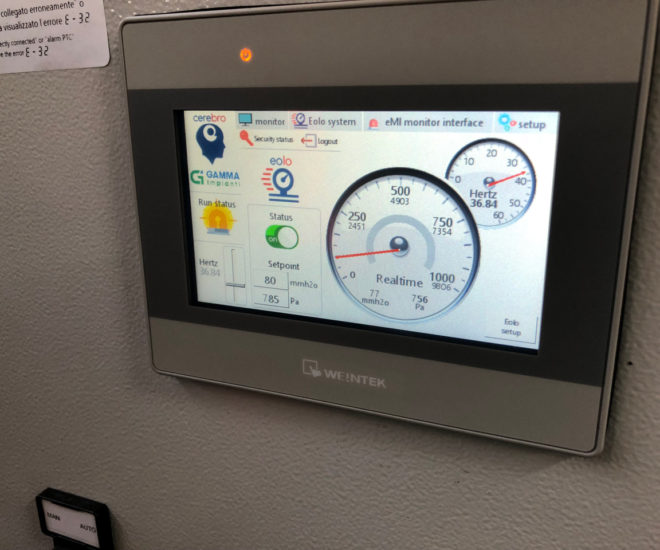

The regulation does not specifically mention suction systems but specifies that the 4.0 system must be controlled by computer systems or managed by appropriate sensors and drives. So in the case of the suction systems this results in these substantial characteristics:

- Automatic turn control of the fan with an inverter, so as to Reduce energy absorption in case the system is underused<strong/li>

- Clogging filters with real-time reporting of the different thresholds and alarm sent via email to the maintenance service

- Remote management and

- Control and signaling anomalies or threshold levels of all possible sensors in the suction system, such as tribometric probes, rotovalvole, exhaust augers or fire sensors.

But then what are the suction systems that fall under the tax credit 2020?

From a technical point of view, the fundamental requirement remains that of 2019, that the suction systemis equipped with a series of filters that can constantly monitor the state of clogging.

As a result, all suction systems with a filtration system are included, such as:

- Smoke and dust suction systems with metal and pocket filters

- Suction systems with filtration to self-cleaning cartridges for fumes and microdust

- Suction equipment and bag filtration for large quantities of dust

- Suction and sewage systems with active carbonsfor odours and fumes SOV/COV

How to be sure you are compliant

The regulation lists a whole series of technical characteristics that the suction systems must possess in order to be facilitated, that is they must be equipped with features such as control by means of CNC (Computer Numerical Control) and/or PLC (Programmable Logic Controller), as well as the interconnection to factory computer systems with remote loading of instructions and/or part program ed, Furthermore, automated integration with the factory logistics system or with the supply network and/or with other machines of the production cycle.

Our services for suction systems with 2020 tax credit

- Preanalysis of the technical needs and investments to be made, in order to correctly set the expenditure and the system according to the characteristics of Industry 4.0

- Technical report and documentation accompanying the use of hyperamortization, including an EURISP certification to be held in the company for any tax checks

Contact us for more information or to request a quote.